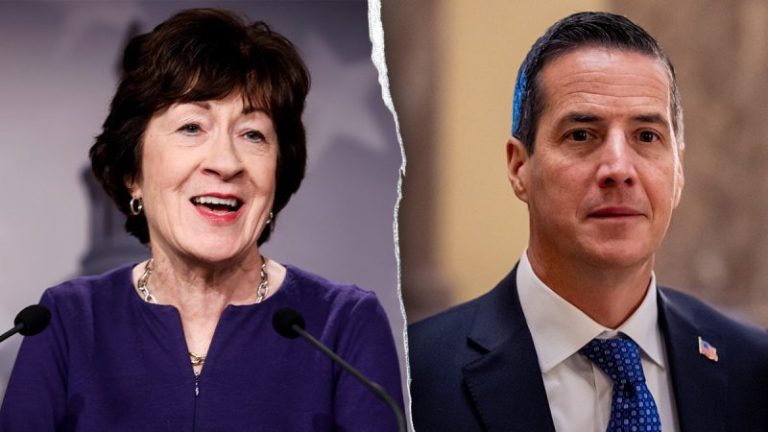

NorthStar Gaming Holdings Inc. (TSXV: BET,OTC:NSBBF) (OTCQB: NSBBF) (‘NorthStar’ or the ‘Company’) announces that, effective immediately, Michael Moskowitz is no longer the Company’s Chief Executive Officer (‘CEO’) or Chair of its Board of Directors (the ‘Board’).

CEO Transition

The Board has appointed Corey Goodman, the Company’s Chief Development Officer and General Counsel, as Interim Chief Executive Officer. Mr. Goodman, who co-founded NorthStar, has extensive experience in online gaming, operational realignment, corporate restructuring, and capital markets. Working closely with the Board, he will guide the Company’s work to refine its cost structure, enhance operational discipline, and to drive improvement efforts in respect of both revenue and profitability.

‘Mr. Goodman has been an essential contributor since the founding of the Company,’ said Dean MacDonald, Director. ‘The Board has full confidence in his leadership and his deep knowledge of our business. His balanced and disciplined approach will help ensure continuity while we focus on strengthening performance and positioning NorthStar for long-term growth.’

NorthStar will continue to update stakeholders as it advances its operational and financial priorities.

Board Update

In connection with Mr. Moskowitz’s departure from the Company as Chief Executive Officer and Chair, Dean MacDonald, who has served on the Board of Directors since 2023, has been appointed Chair of the Board.

Barry Shafran has resigned from the Board of Directors, effective immediately. Mr. Shafran served as Chair of the Audit Committee and the Board thanks him for his service and contributions. An announcement regarding the appointment of an additional independent director and a new Chair of the Audit Committee will be made once the Board has finalized its selection.

About NorthStar

NorthStar proudly owns and operates NorthStar Bets, a Canadian-born casino and sportsbook platform that delivers a premium, distinctly local gaming experience. Designed with high-stakes players in mind, NorthStar Bets Casino offers a curated selection of the most popular games, ensuring an elevated user experience. Our sportsbook stands out with its exclusive Sports Insights feature, seamlessly integrating betting guidance, stats, and scores, all tailored to meet the expectations of a premium audience.

As a Canadian company, NorthStar is uniquely positioned to cater to customers who seek a high-quality product and an exceptional level of personalized service, setting a new standard in the industry. NorthStar is committed to operating at the highest level of responsible gaming standards.

NorthStar is listed in Canada on the TSX Venture Exchange (‘TSXV’) under the symbol ‘BET’ and in the United States on the OTCQB under the symbol ‘NSBBF’. For more information on the Company, please visit: www.northstargaming.ca.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Note Regarding Forward-Looking Information and Statements

This communication contains ‘forward-looking information’ within the meaning of applicable securities laws in Canada (‘forward-looking statements’), including without limitation, statements with respect to the following: expected performance of the Company’s business, including but not limited to, its cost structure, operational discipline and initiatives, and revenue and profitability. The foregoing is provided for the purpose of presenting information about management’s current expectations and plans relating to the future and allowing investors and others to get a better understanding of the Company’s anticipated financial position, results of operations, and operating environment. Often, but not always, forward-looking statements can be identified by the use of words such as ‘plans’, ‘expects’, ‘is expected’, ‘budget’, ‘scheduled’, ‘estimates’, ‘continues’, ‘forecasts’, ‘projects’, ‘predicts’, ‘intends’, ‘anticipates’ or ‘believes’, or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results ‘may’, ‘could’, ‘would’, ‘should’, ‘might’ or ‘will’ be taken, occur or be achieved. This information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. This forward-looking information is based on management’s opinions, estimates and assumptions that, while considered by NorthStar to be appropriate and reasonable as of the date of this press release, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, levels of activity, performance, or achievements to be materially different from those expressed or implied by such forward- looking information. Such factors include, among others, the following: risks related to the Company’s business and financial position; risks associated with general economic conditions; adverse industry risks; future legislative and regulatory developments; the ability of the Company to implement its business strategies; and those factors discussed in greater detail under the ‘Risk Factors’ section of the Company’s most recent annual information form, which is available under NorthStar’s profile on SEDAR+ at www.sedarplus.ca. Many of these risks are beyond the Company’s control.

If any of these risks or uncertainties materialize, or if the opinions, estimates or assumptions underlying the forward-looking information prove incorrect, actual results or future events might vary materially from those anticipated in the forward-looking statements. Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other risk factors not presently known to the Company or that the Company presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking statements. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. No forward-looking statement is a guarantee of future results. Accordingly, you should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this press release represents NorthStar’s expectations as of the date specified herein, and are subject to change after such date. However, the Company disclaims any intention or obligation or undertaking to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

All of the forward-looking information contained in this press release is expressly qualified by the foregoing cautionary statements.

For further information:

Company Contact:

Corey Goodman

Interim Chief Executive Officer 647-530-2387

investorrelations@northstargaming.ca

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277295