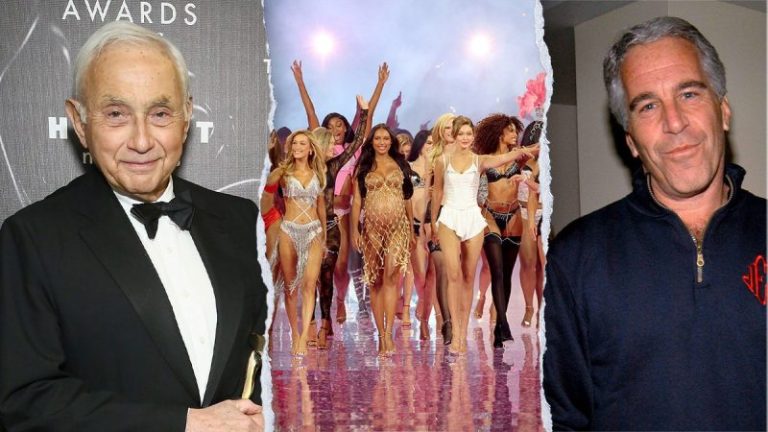

An 88-year-old billionaire businessman and former Victoria’s Secret chief is the latest person to fall within the House Oversight Committee’s investigative crosshairs.

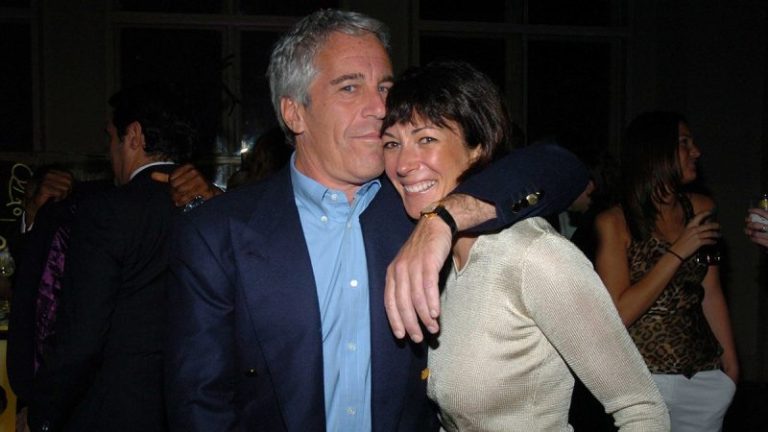

The crimes of late billionaire sex trafficker Jeffrey Epstein are well-known, having gained new media attention in recent months after Congress forced the Department of Justice (DOJ) to disclose millions of pages of documents.

But less is known about the figures who operated within Epstein’s orbit and how they helped him get the vast international sphere of influence he enjoyed before finding himself in a Manhattan jail awaiting trial, where he killed himself in 2019.

Leslie ‘Les’ Wexner, founder of L Brands, the former chief of Victoria’s Secret, is one of those figures, having been named a co-conspirator of Epstein in a recently uncovered FBI document from 2019.

Wexner is the founder of L Brands, formerly known as The Limited, which included Victoria’s Secret, Bath & Body Works, and Pink. He also helped found Abercrombie & Fitch, a clothing brand that was once popular among teens in the U.S.

Wexner has never been charged with crimes related to the late financier, and a spokesperson for the mogul told Fox News Digital that the ‘Assistant U.S. Attorney told Mr. Wexner’s legal counsel in 2019 that Mr. Wexner was neither a co-conspirator nor target in any respect.’

But documents released by the DOJ allege that Wexner was one of the key players in how Epstein built his wealth and later ran his illicit empire.

One file from 2013 that appears to have been in the possession of the Southern District of New York (SDNY) titled ‘Jeffrey Epstein Source of Wealth,’ said Wexner ‘became a well-known client’ of Epstein’s financial management firm in 1987.

At the time, Wexner was identified as the founder and chairman of the Ohio-based women’s clothing brand The Limited.

‘Since all but one of his financial clients are anonymous, it has been speculated that much of Epstein’s lavish lifestyle was once financed by Wexner,’ reads the document, which appears to be an email. Wexner’s spokesperson declined to comment on the allegations.

That paper also noted that Wexner sold his massive Manhattan townhouse — reported to be the largest private residence in the New York City borough — to Epstein.

A 2019 FBI witness statement from a man who purported to be Wexner’s bodyguard from 1991 to 1992 said Wexner ‘sold his mansion in New York to Epstein for $20.’

The same witness statement alleged that ‘Epstein got all of his money from Wexner.’

A 1998 document obtained by Fox News Digital, however, shows Wexner sold his home to Epstein for a $20 million price tag. Half was paid via cashier’s check, while the other half was covered by a promissory note, the record shows.

Epstein’s Manhattan mansion was raided by the FBI in July 2019 as part of the federal sex trafficking investigation. There, law enforcement officials found vast troves of evidence, including photos of partially or fully nude women and girls, including ones who appeared to be minors.

The DOJ’s unsealed indictment against Epstein also said it was one of the places where he ‘enticed and recruited, and caused to be enticed and recruited, dozens of minor girls… to engage in sex acts with him, after which he would give the victims hundreds of dollars in cash.’

Wexner reportedly bought the mansion in 1989 for $13.2 million before selling it to a corporation partially controlled by Epstein for an ‘undisclosed amount,’ according to Business Insider. It was then reportedly transferred to a U.S. Virgin Islands-based company controlled by Epstein for $0 in 2011.

The home was reportedly valued at $77 million at the time of the raid, making it a massive portion of Epstein’s wealth.

A heavily redacted email chain from July 2025 that appears to show witness statement summaries, with the subject line, ‘RE: Epstein – Cellmate Interview,’ also said, ‘Steve Scully stated Wexner was #1 on Epstein’s speed dial.’

Steve Scully appears to be a reference to a former IT contractor who lived and worked on Epstein’s private island of Little St. James from 1999 through 2005. Wexner’s spokesperson declined to comment on Scully’s claim.

Wexner even signed a document in 1991 giving Epstein vast control over his finances via power of attorney, according to the New York Times. That document gave Epstein the power to sign checks, borrow money, and buy or sell real estate on Wexner’s behalf, the report said.

A letter Wexner wrote to his nonprofit, the Wexner Foundation, in August 2019 said that while he did give power of attorney to Epstein, their relationship ended soon after the 2007 federal investigation first began into the late financier in Florida.

‘[B]y early fall 2007, it was agreed that he should step back from the management of our personal finances. In that process, we discovered that he had misappropriated vast sums of money from me and my family. This was, frankly, a tremendous shock, even though it clearly pales in comparison to the unthinkable allegations against him now,’ the letter said.

‘With his credibility and our trust in him destroyed, we immediately severed ties with him. We were able to recover some of the funds. The widely reported payments Mr. Epstein made to the charitable fund represented a portion of the returned monies. All of that money — every dollar of it — was originally Wexner family money.’

But other documents released by the DOJ allege that Epstein and Wexner’s relationship went further than financial management.

An FBI witness statement by Robert Morosky, a former executive for Wexner’s fashion brand, said, ‘He had information regarding the use of ‘Limited’ brand aircraft used in the 1990s to transport young girls from Mexico to the U.S.’

‘Morosky did not wish to give any additional information at that time; however if someone would like to pursue this information he could be reached on his personal cellular phone,’’ the statement said.

It’s unclear if the lead was ever pursued, but a spokesperson for Wexner told Fox News Digital, ‘The allegation is false. Mr. Morosky was terminated from the company in 1987 and therefore in no position to know anything about the use of Limited planes in the 1990s.’

A witness statement from 2020, with the identity of the female witness redacted, said she claimed to have ‘often’ seen Epstein and Wexner together.

She ‘stated that often Wexner would have models who could not have been over 18 years old do private viewings for him and Epstein. She said the models would be wearing [swimsuits] and some were in lingerie,’ the document read.

Wexner’s spokesperson declined to comment on those claims and called her account of seeing the pair together ‘vague.’

The female witness said she ‘would help with getting people to work at parties at Wexner’s compound in catering and other positions,’ and that ‘anyone who went to work there had to have a full background check and there were certain areas of the house where they could not go without an approved escort.’

However, there was no indication of what years or period of time her claims are focused on.

A source with knowledge of company procedures argued the situation could not have happened, however. Model fittings always involved teams of 15 to 20 professionals and Epstein was never a part of that, the source maintained.

Wexner is scheduled to appear before the House Oversight Committee in Ohio on Wednesday morning.

Fox News Digital reached out to Wexner’s attorney for comment on the deposition and on the aforementioned claims.

This post appeared first on FOX NEWS