July 29 (Reuters) – Union Pacific said on Tuesday it would buy smaller rival Norfolk Southern in an $85-billion deal to create the country’s first coast-to-coast freight rail operator and reshape the movement of goods from grains to autos across the U.S.

If approved, the deal would be the largest-ever buyout in the sector and combine Union Pacific‘s stronghold in the western two-thirds of the United States with Norfolk’s 19,500-mile network that primarily spans 22 eastern states.

The two railroads are expected to have a combined enterprise value of $250 billion and would unlock about $2.75 billion in annualized synergies, the companies said.

The $320 per share price implies a premium of 18.6% for Norfolk from its close on July 17, when reports of the merger first emerged.

The companies said on Thursday they were in advanced discussions for a possible merger.

The deal will face lengthy regulatory scrutiny amid union concerns over potential rate increases, service disruptions and job losses. The 1996 merger of Union Pacific and Southern Pacific had temporarily led to severe congestion and delays across the Southwest.

The deal reflects a shift in antitrust enforcement under U.S. President Donald Trump’s administration. Executive orders aimed at removing barriers to consolidation have opened the door to mergers that were previously considered unlikely.

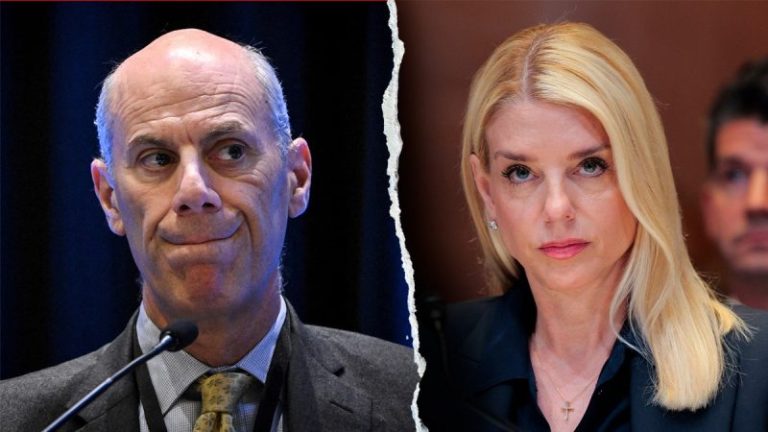

Surface Transportation Board Chairman Patrick Fuchs, appointed in January, has advocated for faster preliminary reviews and a more flexible approach to merger conditions.

Even under an expedited process, the review could take from 19 to 22 months, according to a person involved in the discussions.

Major railroad unions have long opposed consolidation, arguing that such mergers threaten jobs and risk disrupting rail service.

“We will weigh in with the STB (regulator) and with the Trump administration in every way possible,” said Jeremy Ferguson, president of the SMART-TD union‘s transport division, after the two companies said they were in advanced talks last week.

“This merger is not good for labor, the rail shipper/customer or the public at large,” he said.

The companies said they expect to file their application with the STB within six months.

The SMART-TD union‘s transport division is North America’s largest railroad operating union with more than 1,800 railroad yardmasters.

The North American rail industry has been grappling with volatile freight volumes, rising labor and fuel costs and growing pressure from shippers over service reliability, factors that could further complicate the merger.

Union Pacific‘s shares were down about 1.3%, while Norfolk fell about 3%.

The proposed deal had also prompted competitors BNSF, owned by Berkshire Hathaway BRKa.N, and CSX CSX.O, to explore merger options, people familiar with the matter said.

Agents at the STB are already conducting preparatory work, anticipating they could soon receive not just one, but two megamerger proposals, a person close to the discussions told Reuters on Thursday.

If both mergers are approved, the number of Class I railroads in North America would shrink to four from six, consolidating major freight routes and boosting pricing power for the industry.

The last major deal in the industry was the $31-billion merger of Canadian Pacific CP.TO and Kansas City Southern that created the first and only single-line rail network connecting Canada, the U.S. and Mexico.

That deal, finalized in 2023, faced heavy regulatory resistance over fears it would curb competition, cut jobs and disrupt service, but was ultimately approved.

Union Pacific is valued at nearly $136 billion, while Norfolk Southern has a market capitalization of about $65 billion, according to data from LSEG.

(Reuters reporting by Shivansh Tiwary and Sabrina Valle, additional reporting by Abhinav Parmar, Nathan Gomes and Mariam Sunny; Reuters editing by Sriraj Kalluvila, Pooja Desai, Dawn Kopecki and Cynthia Osterma)