Iran’s militant and unyielding supreme leader, Ayatollah Ali Khamenei, who ruled the Islamic Republic for more than three decades and oversaw an era of harsh internal repression and confrontation with the United States and Israel, has died following the Israeli strike in Tehran, as his compound was reduced to rubble, a senior Israeli official told Fox News Digital.

‘Khamenei was the contemporary Middle East’s longest-serving autocrat. He did not get to be that way by being a gambler. Khamenei was an ideologue, but one who ruthlessly pursued the preservation and protection of his ideology, often taking two steps forward and one step back,’ Behnam Ben Taleblu, senior director of FDD’s Iran program, told Fox News Digital.

‘Khamenei’s worldview was shaped by his militant anti-Americanism and antisemitism, which first manifested itself in his protests against the Shah of Iran,’ he added.

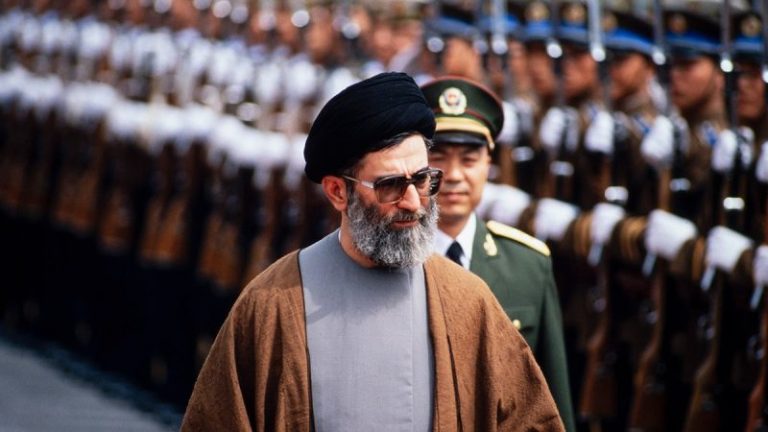

Born April 19, 1939, in Mashhad, eastern Iran, Khamenei was among the Islamist activists who played a central role in the 1979 revolution that overthrew the U.S.-backed Shah Mohammad Reza Pahlavi. A close ally of Iran’s first supreme leader, Ayatollah Ruhollah Khomeini, Khamenei rose through the new system and served as president from 1981 to 1989 before becoming supreme leader after Khomeini’s death that same year.

Decades in power, Khamenei consolidated control over Iran’s political and security system, presiding over repeated crackdowns on dissent and maintaining a hardline posture toward Washington and Jerusalem.

‘Ayatollah Ali Khamenei’s rule has been marked by unrelenting brutality and repression, both within Iran and beyond its borders,’ said Lisa Daftari, an expert on Iran and editor-in-chief of The Foreign Desk. She pointed to executions and the enforcement of strict social controls as defining features of the system under Khamenei’s leadership.

His ultra-conservative style of leadership did face challenges, however. In 2009, following disputed elections in which Khamenei declared victory for the incumbent president, Mahmoud Ahmadinejad, massive protests erupted across the country.

Mass demonstrations also broke out in 2022 after Mahsa Amini, a 22-year-old woman, died while detained by the morality police for allegedly wearing her headscarf improperly. The protests were brutally put down, with many of those arrested and put to death by his regime.

In late December, Iran was again rocked by protests and a fierce brutal security response. According to an Iran International investigation, as many as 30,000 people may have been killed across two days, Jan. 8 to 9, 2026.

International monitors and rights groups have repeatedly documented high execution numbers in Iran in recent years as well. Amnesty International said Iranian authorities executed more than 1,000 people in 2025, calling it the highest yearly figure the organization recorded in at least 15 years. Separately, a U.N. report said Iran executed at least 975 people in 2024, the highest number since 2015.

Across the region, Khamenei invested heavily in Iran’s network of allied militias and armed groups, a strategy used to project Iranian power beyond its borders. From the West Bank and Gaza, where he backed terror groups such as Hamas, to Hezbollah in Lebanon and Houthi extremists in Yemen, as well as other militant militias in Iraq, Iran under Khamenei’s spent hundreds of millions of dollars on the terror groups.

However, his prized proxies, as well as the regime of Bashar al-Assad in Syria, collapsed under Israeli military pressure following the Oct. 7, 2023, attack. During a 12-day war in June 2025, Israel also succeeded in taking out some of Khamenei’s closest aides and senior security figures, leaving the long-serving leader significantly weakened.

Yet analysts argue that Khamenei’s most enduring legacy may be the institutional machinery he built at home to safeguard the system.

A recent report by United Against Nuclear Iran (UANI), authored by Saeid Golkar and Kasra Aarabi, describes the Bayt, the Office of the Supreme Leader, as a parallel structure embedded across Iran’s military, economy, religious institutions and bureaucracy.

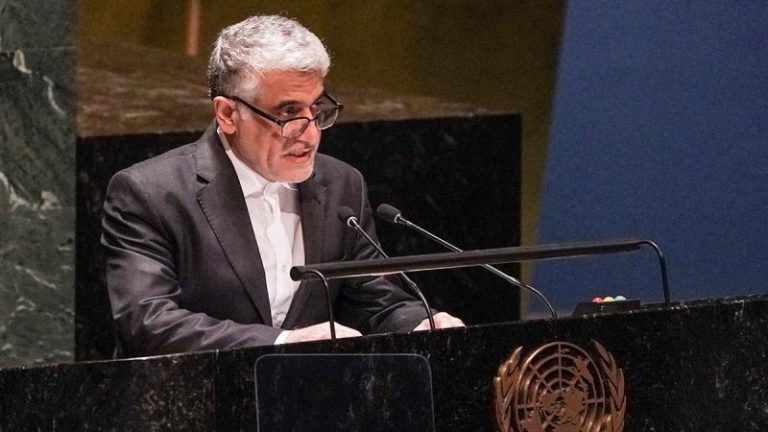

In an interview with Fox News Digital, Aarabi said, ‘It is the hidden nerve center of the regime in Iran… it operates as a state within a state.’ He argued that even Khamenei’s removal would not necessarily dismantle the system. ‘Even if he is eliminated, the Bayt as an institution enables the Supreme Leader to function,’ Aarabi said, adding, ‘Think of the Supreme Leader as an institution rather than just a single individual.’

Aarabi also warned that ‘eliminating Khamenei in isolation on its own is not enough,’ calling for a broader strategy aimed at the wider apparatus surrounding the supreme leader. ‘You have to dismantle this extensive apparatus that he has created,’ he said.

‘Unlike Khomeini, the founding father of the Islamic Republic, Khamenei institutionalized his power. Today, the Islamic Republic is more a product of Khamenei than Khomeini,’ FDD’s Ben Taleblu added.