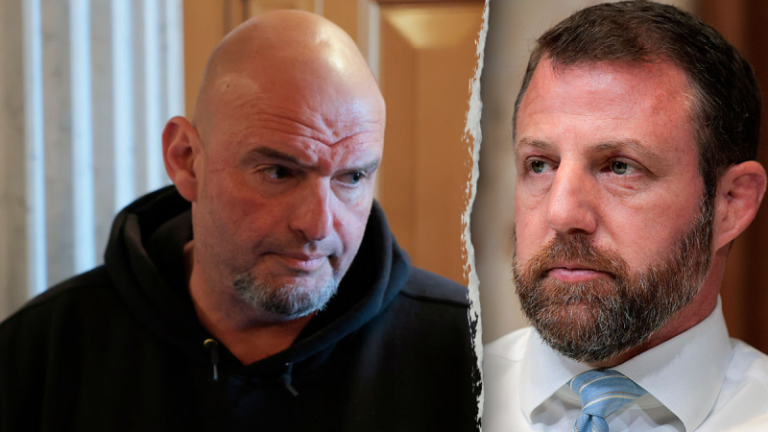

Sen. Markwayne Mullin, R-Okla., was just tapped to replace embattled Homeland Security Secretary Kristi Noem, but first he must be confirmed by the Senate.

But with anger and frustration over the direction of the Department of Homeland Security under Noem still simmering, and the agency still shut down, Senate Democrats aren’t likely to make that an easy process.

Still, Mullin said he was ready for the challenge ahead.

‘We’re going to try to earn everybody’s vote,’ Mullin said.

‘I want people to understand I’m not — when I go into this position, yes, I’m a Republican, yes, I’m conservative,’ he continued. ‘But the Department of Homeland Security is to keep everybody — regardless of whether you support me, if you don’t support me, regardless of what your thoughts are — I’m here to enforce the policies that Congress passed.’

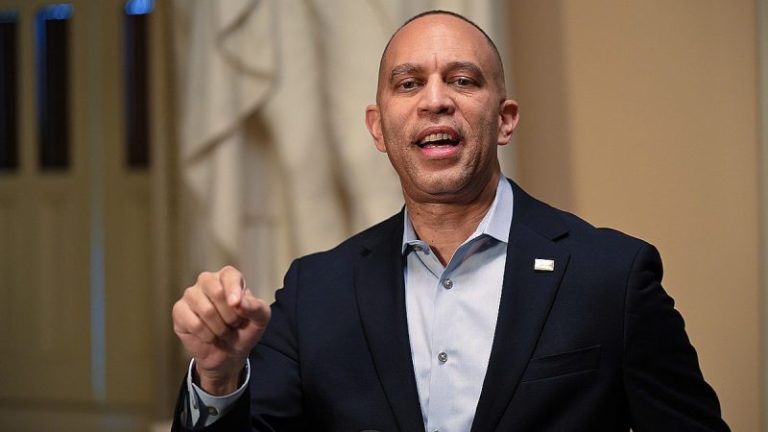

Mullin’s confirmation process could become the next battleground for Senate Minority Leader Chuck Schumer, D-N.Y., and Democrats to continue their campaign of handcuffing Immigration and Customs Enforcement (ICE).

They have so far rejected every offer from the White House on compromise reforms to the agency and on Thursday again blocked a full-year funding bill to reopen DHS.

‘I’ve been asked if I would support Sen. Mullin as Noem’s replacement,’ Schumer said on X. ‘The answer is a resounding NO. The rot in DHS is deep, much deeper than any individual. It’s a question of policy, not personnel. The Senate should not consider any DHS Secretary nominee until DHS and ICE are reined in.’

Mullin said that he would sit down with Schumer if the top Senate Democrat wished, but reiterated that he was after every Democrats’ vote for the job.

‘At the end of the day, all I can do is do my job,’ Mullin said. ‘I’m not going to get into, you know, a tit-for-tat, but if they have real concerns, I’m going to listen to it. I’m going to see if it’s practical. But nothing’s going to prevent me from doing my job.’

Floor and committee time is a valuable commodity in the Senate, which is currently processing a colossal housing package and still trying to reopen the very agency Mullin has been tapped to run.

Senate Majority Leader John Thune, R-S.D., hopes to get the ball rolling quickly to fill the position, given that President Donald Trump set Noem’s exit date from the job for March 31.

‘He’s obviously pretty well-vetted around here, so hopefully we can get the process going, because I think that’s a position that’s going to need to be filled quickly,’ Thune said.

And Noem’s confirmation last year wasn’t a smooth process, either. The Senate confirmed her 59 to 34, with only seven Senate Democrats voting with all Republicans to install her in the position.

Sen. Gary Peters, D-Mich., was one of the few who joined Republicans to confirm Noem. He’s also the top-ranking Democrat on the panel and will be heavily involved in vetting his colleague for the position.

When asked by Fox News Digital if he envisioned hurdles for Mullin ahead, Peters said, ‘I don’t know.’

‘I haven’t thought about it yet,’ he said. ‘This is all new information, so give me time to process it. Then I’m happy to answer questions.’

Trump’s decision to tap Mullin comes as support among Senate Republicans for Noem was crumbling. She faced a grilling from Sens. Thom Tillis, R-N.C., and John Kennedy, R-La., during a Senate Judiciary Committee hearing earlier in the week, and many Republicans weren’t quick to say they still backed her afterward.

Others were still in her corner.

‘I think Kristi Noem has done a good job,’ Sen. Rick Scott, R-Fla., said.

Still, despite what could become a grueling confirmation effort, Mullin has at least one Senate Democrat he doesn’t have to worry about supporting him: Sen. John Fetterman, D-Pa., who called the lawmaker a ‘nice upgrade’ compared to the outgoing Noem.

‘Yes, we’re in a different party, but this is the choice,’ Fetterman said. ‘I want to work together to make our America more secure.’

Related Article

Schumer, Dems hold firm on DHS funding despite Noem’s bombshell ousting

This post appeared first on FOX NEWS